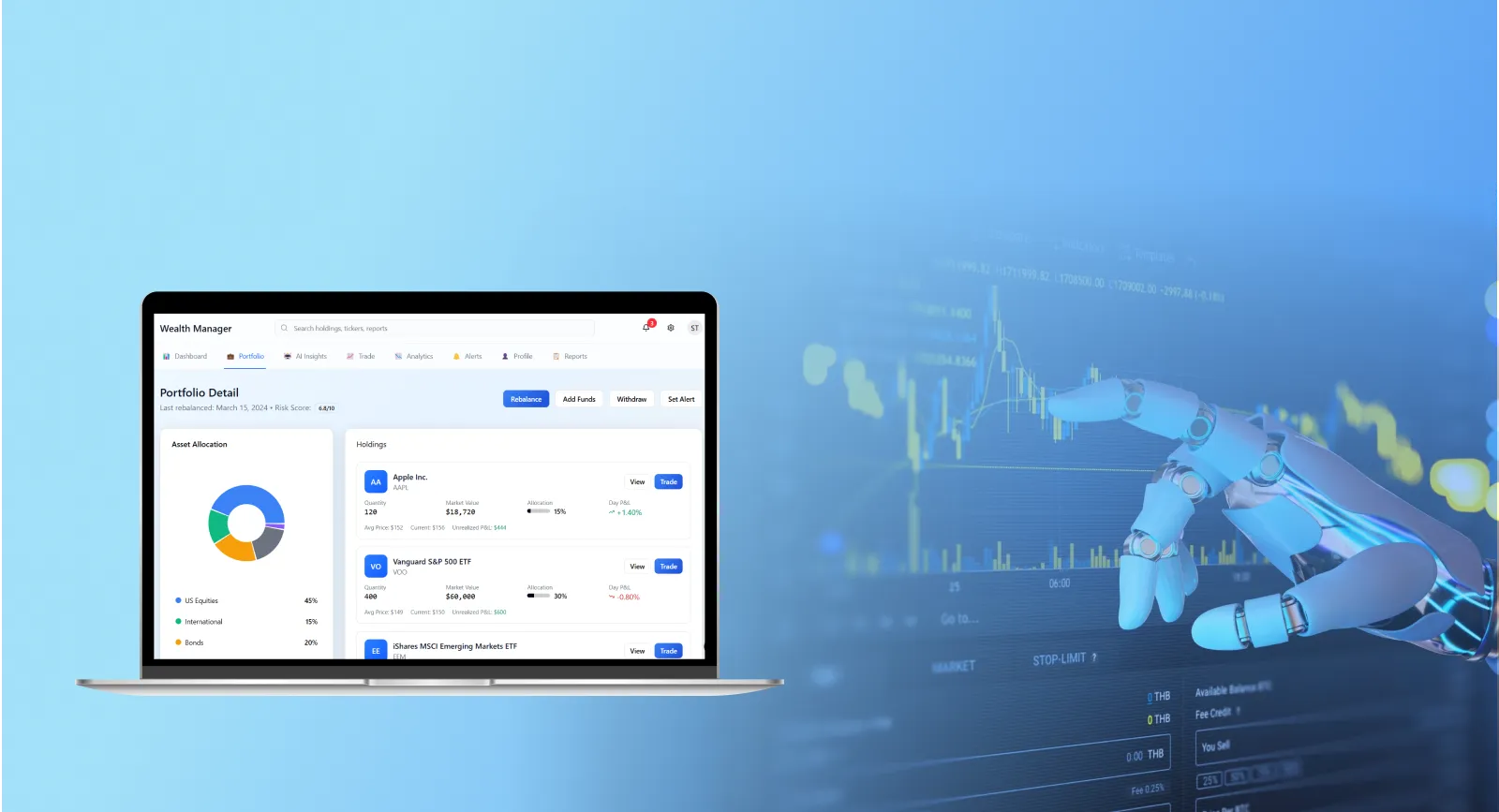

Project Overview

A top-tier wealth management firm sought to redefine its investment management approach by integrating AI, data analytics, and automation.

The goal was to empower advisors and investors with real-time insights, predictive risk models, and automated rebalancing.

Performance at a Glance

37%

average portfolio growth through personalised AI insights.

25%

reduction in portfolio errors via automated simulations and rebalancing.

2 ×

faster portfolio reviews driven by predictive analytics and smart dashboards.

Client Goals

Client Goals

- Deliver personalised, goal-based investment strategies for each client.

- Increase transparency and engagement through interactive dashboards and insights.

- Reduce human error and manual workload in portfolio rebalancing and analysis.

- Enable predictive risk management to safeguard investments during volatility.

- Build a unified, scalable, and regulatory-compliant wealth management platform.

Key Pain Points

Manual portfolio reviews led to slow reaction times and missed opportunities.

Inconsistent portfolio rebalancing increased exposure to unnecessary risk.

Fragmented tools and data silos limited the accuracy of investment insights.

Advisors struggled to personalise recommendations across large client bases.

Clients lacked visibility into performance metrics and actionable portfolio insights.

How We Helped

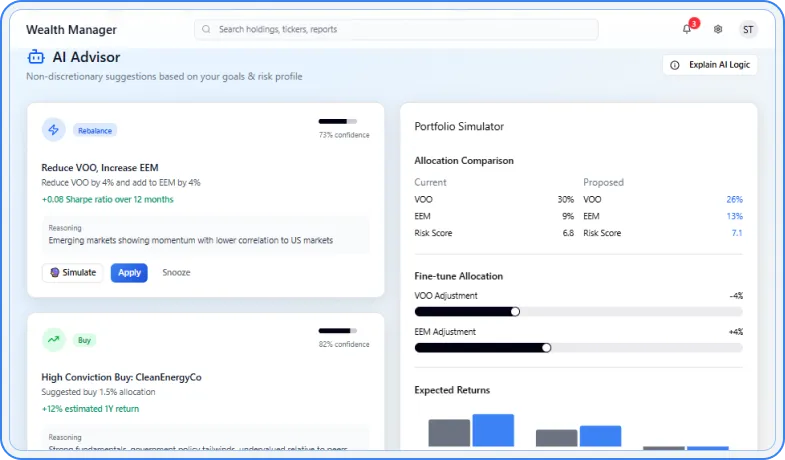

- Automated rebalancing suggestions based on client risk profiles, asset performance, and market trends.

- Portfolio simulator allows users to simulate changes before applying, ensuring transparency and control.

1. AI-Powered Portfolio Optimization:

Result: Smarter portfolio decisions driving consistent client growth.

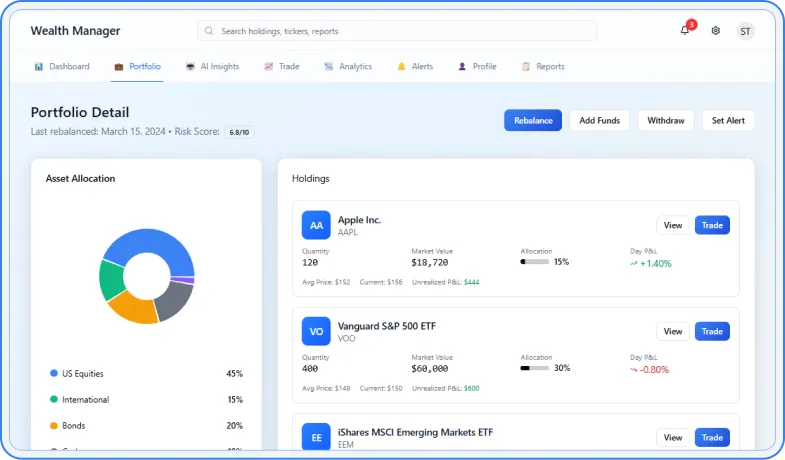

- Real-time portfolio overview featuring asset allocation, top holdings, and performance metrics.

- Interactive visualisations display volatility, correlation, and drawdown trends at a glance.

2. Unified Dashboard for Advisors & Clients:

Result: Faster portfolio reviews and improved advisor–client collaboration.

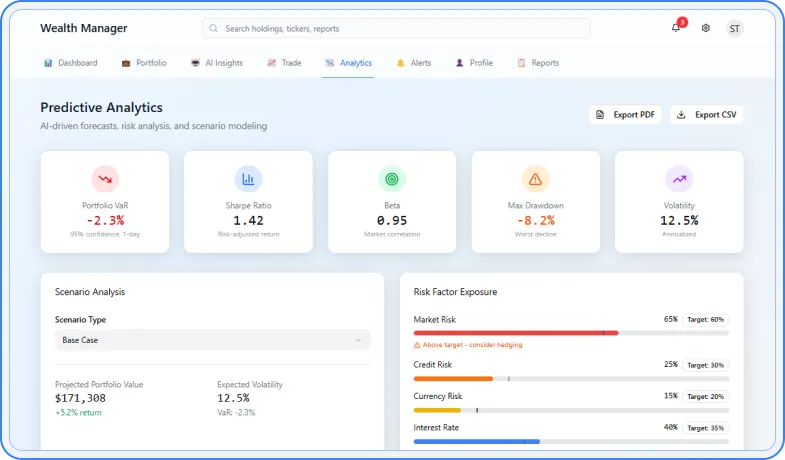

- AI-driven scenario analysis with continuous learning algorithms, Monte Carlo simulations, and stress testing to evaluate portfolio resilience.

- AI models calculate Value-at-Risk (VaR) forecasts with 95% confidence intervals, enabling proactive and data-driven risk management.

3. Predictive Analytics & Risk Modeling:

Result: Reduced exposure to risk during market volatility.

- Automated buy/sell/hedge recommendations with reasoning and answering the “why” behind each recommendation and expected ROI impact.

- “Simulate” feature lets users test potential portfolio changes under bull, base, and bear scenarios.

4. AI Advisory & Simulation Tools:

Result: Informed investment actions boosting client confidence.

- Smart notification system prioritises high-impact alerts, helping investors respond instantly to market movements.

- Fully customisable settings allow users to tailor alerts by portfolio, asset class, or specific performance thresholds.

5. Alerts & Notifications:

Result: Quick investor response to market movements.

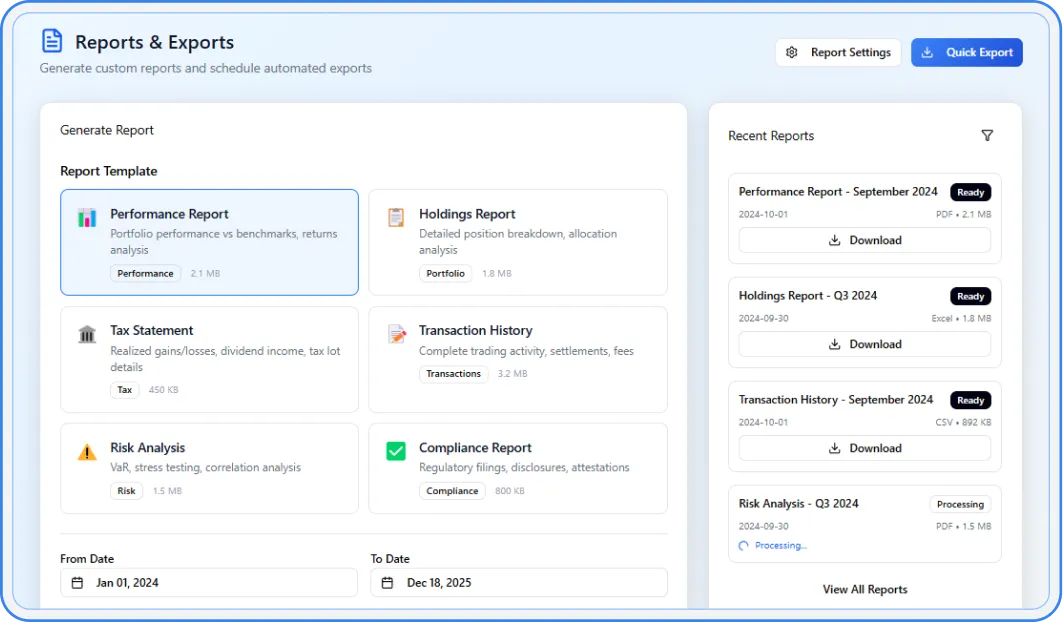

- Auto-generated performance, holdings, tax, and risk reports with PDF/Excel export.

- Scheduled and on-demand reporting enables advisors and clients to access up-to-date insights anytime.

6. Comprehensive Reports & Compliance Tools:

Result: Transparent reporting enhances trust and regulatory compliance.

Want to transform portfolio performance with AI-powered wealth intelligence?

Talk to Our Experts TodayResults That Matter

37% portfolio growth through smarter, faster investment decisions.

25% fewer portfolio errors due to AI-guided simulations and automated rebalancing.

2× faster portfolio reviews with predictive analytics and visualised risk scoring.

Increased client engagement with interactive dashboards and personalised insights.

Improved transparency via detailed performance, tax, and risk reporting.

How We Gave Them a Competitive Edge

How We Gave Them a Competitive Edge

- Personalised AI Advisory: Dynamic, data-backed recommendations tuned to each investor’s risk and goals.

- Data-Driven Portfolio Management: Predictive analytics offering clear foresight into portfolio performance.

- Operational Efficiency: Advisors manage multiple portfolios with speed and accuracy through automation.

- Enhanced Client Trust: Transparent dashboards and simulated scenarios build investor confidence.

- Future-Ready Platform: Scalable architecture ready for integration with new assets and markets.

Solution Walkthrough

Portfolio Dashboard:

Displays total net worth, day’s performance, and top holdings with drill-down visibility.

AI Insights:

Smart suggestions such as “High Conviction Buy” or “Consider Hedging” with confidence scoring and reasoning.

Portfolio Simulator:

Compares current vs proposed allocation, risk scores, and expected returns under different market scenarios.

Reports & Exports:

Comprehensive, scheduled exports covering performance, holdings, tax, and compliance in PDF or CSV formats.

Analytics Section:

Visualises volatility, correlation, and drawdown data with predictive modeling and stress testing.

Alerts & Notifications:

Real-time alerts on volatility spikes, dividend updates, and market shifts, helping investors act instantly.

// We are here to help you

Trusting in Our Expertise

- 30 Hours Risk Free Trial.

- Direct Communication With Developer.

- On-time Project Delivery Assurity.

- Assign Dedicated PM.

- Get Daily Update & Weekly Live Demo.

- Dedicated team 100% focused on your product.

- Sign NDA for Security & Confidentiality.